For many years, gold has been used as an investment opportunity by investors to hedge against inflation. Historically, it has been seen that the performance of gold, as an asset class is inversely proportional to that of equity; i.e. generally when the equity markets fall, the demand for gold picks up and vice versa. Gold assets introduce the required diversification in your portfolio. Let’s say; it is a teamwork between the two classes that makes your portfolio more stable.

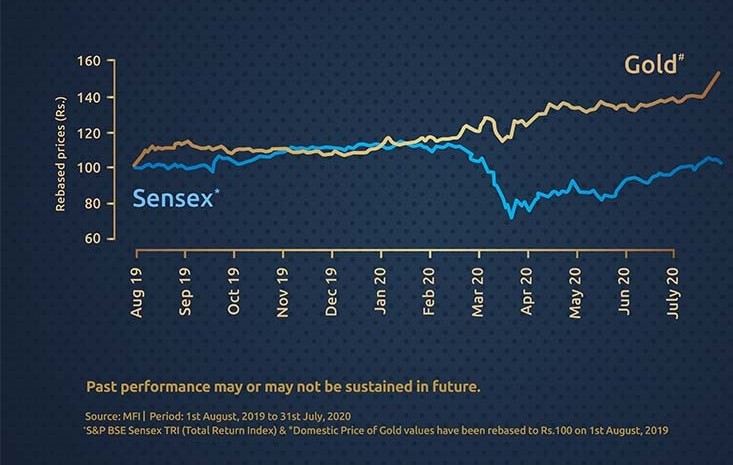

Consider the below graph that shows the actual performance of the S&P BSE Sensex TRI(Total Return Index) and Domestic Gold prices in the Indian market over the period of August’19 to July’20, wherein the Y-axis shows the rebased prices of both the asset classes. As you can see, the inverse relationship between the two asset classes is clearly visible in their performance record.

As an investor, you will appreciate the fact that every asset class has its own performance path over various time periods. Additionally, the various market forces at play make it difficult to be able to predict the performances of these asset classes. You may not have the skill, time, and the expertise to be able to foresee these changes and align your portfolio accordingly. Hence, the need to diversify into gold as an asset class.

- gold ETF and gold funds are one of the ways of investing in Gold as an asset class . Gold ETF : A gold ETF buys physical gold of 99.5% purity. The objective here is to replicate the price performance of physical gold. Gold Funds : A gold fund is a Fund of Fund (FoF) that invests in the Gold ETFs that invest in bullion gold of 99.5%.

To invest in Gold ETFs, you need a Demat account whereas, for Gold Funds, you do not. Gold Funds may have a higher expense ratio when compared to Gold ETFs because the investors will be bearing the recurring expenses of the scheme, in addition to the expenses on the underlying scheme. In Gold Funds, the option of an SIP mode of investment is readily available, whereas in Gold ETF it is possible only if the broker offers a stock SIP option.

However, you will have to go through the one-time mandatory KYC process before investing in any of the gold schemes of an AMC.

99.5% Purity of Gold : If you invest via Gold ETFs, you invest in physical gold of 99.5% purity. However, in case of a Gold Fund, the underlying scheme i.e. Gold ETF invests in physical gold of 99.5% purity, andtracksthe performance of the domestic price of gold. So, you do not have to worry about the quality of gold you are investing in. No Storage Hassle : A precious commodity like gold when taken in physical form needs to be kept safely & securely as the chances of it getting misplaced or lost are higher. However, when you invest in gold via mutual funds, there is no storage hassle. Relevant diversification : The gold asset class can help you with asset diversification in your portfolio has the potential to mitigate the risk because different asset classes have different levels of risks associated with them. This diversification has the potential of affecting your returns positively over a long-term investment horizon. Your portfolio is better off being a good mix of asset classes like equity, debt and gold and more, as the need be. Investment in gold helps you in allocating your assets such that your risks are not completely invested in an asset class.